Standard home warranties are designed to provide homeowners with hassle-free, affordable maintenance for essential appliances and home systems as they break down over time due to normal wear. However, many home warranties only cover roof leak coverage, and in most cases, it’s optional, so policyholders must add it to their coverage. Many leading providers have expanded their coverage to include other integral parts of the home, like the roof.

However, many home warranties only cover roof leak coverage, and in most cases, it’s optional, so policyholders must add it to their coverage for peace of mind.

Here are the top picks to keep a roof over your head.

The Best Home Warranties that Cover Roofs in 2024

Today’s Homeowner’s line-up of the best home warranty companies for roof coverage highlights reputable warrantors with prompt customer service, competitive pricing, and fair coverage. These five recommended providers offer home warranties that cover roofs.

Our top home warranty contenders for premier roof protection include:

Compare the Top Home Warranty Companies That Cover Roofs

Explore the table below for details on the best home warranty companies for roof coverage and more. Then, continue reading in-depth reviews of several top providers.

| Company | Rating | Monthly Cost | Service Fee | Response Time | BBB Rating | Link |

|---|---|---|---|---|---|---|

|

$50-$60 |

$75 |

12-48 hrs. |

NR |

VISIT SITE | |

|

$35–$75 |

$100–$125 |

24-72 hrs |

B |

VISIT SITE | |

|

$44.99-$58.99 |

$70 |

48 hours |

A+ |

VISIT SITE | |

|

$46–$55 |

$85 |

24-48 hrs. |

B |

VISIT SITE | |

|

$52–$58 |

$60 |

24-48 hrs. |

B |

VISIT SITE | |

|

$38–$62 |

$75–$125 |

48 hours |

B |

VISIT SITE | |

|

$38–$48 |

$75–$125 |

48 hours |

B |

VISIT SITE | |

|

$17–$60+ |

$65–$100 |

2–24 hrs |

A- |

VISIT SITE | |

|

$28–$68 |

$100–$150 |

2–24 hrs |

B |

VISIT SITE |

Quote and cost data gathered January 2024. Cost data are updated and monitored continuously.

Liberty Home Guard

4.6

Our Rating

As the only accredited home warranty company with an A rating from the BBB, we’ve deemed Liberty Home Guard (LHG) one of the most trustworthy home protection providers on the market.

Liberty Home Guard is an excellent choice for first-time homebuyers who may feel overwhelmed by the minutiae of different coverage variations available. LHG keeps its benefits schedule simple by offering three basic plans — one for major appliances, one that only covers systems, and another that combines the two.

Limited roof leak coverage is just one of the 41 different elective plan add-ons that Liberty Home Guard offers.

- Exhaustive list of coverage riders, including a few unique items like carpet cleaning, electronics protection, generators, pest control, exterior power washing, TV mounting, and more.

- Contact terms aren’t binding, so customers are free to cancel at any time

- Claims are generally processed within 48 hours of submission

- Appliance Guard ($70 per month / $700 per year): Covers 12 home appliances, including clothes washers and dryers, refrigerators, built-in microwaves, dishwashers, garbage disposals, ranges, ovens, stovetops, ceiling fans, exhaust fans, garage door openers

- Systems Guard ($74.99 per month / $750 per year): Covers six major home systems, including air conditioning, heating, ductwork, plumbing, electrical, and water heaters

- Total Home Guard ($79.99 per month / $799.99 per year): Combo plan the two previous packages covering a total of 20 total appliances and home systems

- Service Fee: $75

- Optional Add-Ons ($49.99-$299.99 per year): Offers 41 additional coverage with everything from limited roof leak protection to specialty coverage for pro-series appliances with luxury features

For $14.99 a month, LHG’s limited roof leak coverage strictly covers customers for roof leak patch repairs only over shared common areas of single-family homes. On occasion, LHG offers a limited-time discount where roof leak protection is free for new customers.

American Home Shield

4.3

Our Rating

A veteran of the home warranty industry, American Home Shield (AHS) holds a B rating with the Better Business Bureau (BBB) and has paid out over $2 billion in claims in the last five years alone. AHS offers three different standard plan options with cumulative coverage, allowing customers to select a level of protection that best suits their budget.

American Home Shield provides roof coverage as optional add-ons for customers looking to maximize their home warranty coverage, or automatically in its comprehensive ShieldPlatinum plan. American Home Shield provides roof coverage as optional add-ons for customers looking to maximize their home warranty coverage, or automatically in its comprehensive ShieldPlatinum plan.

- Customers can choose between three different deductibles depending on whether they want to save money on their annual premium or pay less upfront should they ever need to request service.

- Annual coverage caps are either $3,000 or $6,000 per appliance, depending on your plan level, which is more generous than the industry norm

- Preliminary property inspections aren’t required for enrollment eligibility

- ShieldSilver ($29.27- $44.27 per month / $347.88 – $527.88 per year): Covers 19 systems including heating, cooling, ductwork, electrical systems, ventilation, doorbells and chimes, interior plumbing, faucets, and more.

- ShieldGold ($39.27 – $54.27 per month / $467.88 – $647.88 per year): Covers 23 items, namely featuring kitchen and laundry appliances like ranges/cooktops, dishwashers, instant hot/cold water dispensers, clothes washers, and dryers, etc.

- ShieldPlatinum ($59.27 – $74.27 per month / $711.88 – $891.88 per year): Combines 27 of the above appliances and systems plus automatic roof leak coverage.

- Service Fee: $75, $100, or $125

- Optional Add-Ons: Offers four riders for roof leak repairs, pools/spas, coverage for guest units under 750 square feet in size, septic systems, and well pumps

Leaks present in metal roofs, partial and full green roofs, roof-mounted installations (like solar panels), gutters, and downspouts are not covered by AHS. Roof leak coverage is also not offered in Hawai’i. Coverage is capped at $1,500 per contract term.

Elite Home Warranty

4.3

Our Rating

Since 2020, Elite Home Warranty (EHW) has been a popular choice among landlords, homeowners, and real estate companies. Although new to the scene, EHW has garnered an A+ rating with the Better Business Bureau (BBB) and hundreds of positive reviews. It has great customer service, easy-to-understand contracts, and affordable pricing.

Although Elite Home Warranty does not cover roofs in its three standard plans, it does offer limited roof leak repair as an optional add-on. For an extra $99.99 per year, this add-on will cover patching repairs on a roof if it results in an interior leak to an occupied living space. It has a decent coverage limit of $1,000 per year.

Along with this optional roof leak coverage, EHW has emergency repair services, affordable pricing, and fully customizable plans.

Elite Home Warranty has three home warranty plans. One for your appliances, another for your home systems, and a third that covers both appliances and home systems.

- Elite Appliances (starting at $44.99 a month): This plan provides coverage for eight home appliances, including your refrigerator (including ice maker and water), range/oven/cooktop, dishwasher, built-in microwave, garbage disposal, clothes washer, clothes dryer, and ceiling fans.

- Elite Systems (starting at $49.99 a month): This plan provides coverage for eight home systems, including your plumbing stoppage, plumbing fixtures, plumbing system, air conditioning system, heating system, electrical system, water heater, and garage door opener.

- Elite Complete (starting at $58.99 a month): Covers all items in the Elite Appliances and Elite Systems plans.

Elite Home Warranty also allows full customization of its plans.

Optional Add-Ons ($59.99-$349.99 per year): EHW offers 30 optional add-ons including:

- Annual Maintenance

- Pool & Spa Equipment

- Pool Equipment

- Freestanding Spa Equipment

- Generator

- Limited Roof Leak Repair

- Septic System

- Sump Pump

- Well Pump

- Ejector Pump

- Grinder Pump

- Effluent Pump

- Lift Pump

- Lawn Sprinkler System

- Service Line

- Freestanding Freezer

- Central Vacuum

- Jetted/Hot Tub

- Wine Cooler

- Freestanding Ice Maker

- Water Softener

- Water Filtration System

- Attic Exhaust Fan

- Swamp Cooler

- Guest House

- Premium Appliances

- Premium Systems

- Premium Systems Plus

- Premium Benefits

- Geothermal Heating And Cooling System

EHW’s exclusions include commercial appliances, appliances, and home systems older than ten years, and no 90-day guarantee on repairs if you choose your own contractor. Exclusions vary by state, so ask for a sample contract to be sure what is excluded.

Roof repairs through EHW have a $1,000 limit per year

Choice Home Warranty

4.3

Our Rating

Founded in 2008, Choice Home Warranty (CHW) may be a fairly new home warranty provider next to some of its competitors, but its two standard coverage levels are a popular pick among homeowners, landlords, and even real estate professionals.

In addition to its primary plans, Choice Home Warranty also has eight optional add-on items available for purchase, including its limited roof leak coverage. For an extra $70 per year, Choice’s roof coverage is available for shake, shingle, and composition roofs but only covers common areas of the house (no porches or patios).

- Has a workmanship guarantee for 90 days or parts and 60 days on labor

- Offers 24/7/365 live claims services with prompt response times, so you’ll always have access to your policy benefits at any hour.

- Dispatches a pre-screened in-network technician within 48 hours of your claim submission

- The Basic Plan ($45 per month / $560 per year): Covers 14 home systems and appliances, including but not limited to heating systems, electrical systems, plumbing systems, and stoppages, water heaters, whirlpool bathtubs, cooktops, and dishwashers

- The Total Plan ($53.33 per month / $660 per year): Covers 18 items such as clothes washers, clothes dryers, refrigerators, and air conditioning systems

- Service Fee: $85 or the actual cost of the repair, whichever is less

- Optional Add-Ons ($40-$180 per year): Offers nine optional add-on items including limited roof leaks, pools/spas, central vacuums, second refrigerator, standalone freezers, well pumps, sump pumps, septic systems, and septic tank pumping

Exclusions include skylights, solar equipment, and total or partial roof replacement. Roof repairs through CHW have a coverage limit of $500 per policy period

Select Home Warranty

4.2

Our Rating

Select Home Warranty offers some of the most cost-effective yet comprehensive plans on the market, with standard home protection starting at just $1 per day, alongside low service fees and free roof leak coverage.

- Offers several irresistible seasonal promotions for new joiners, including two free months of coverage and an automatic $150 off any of its three plan options if you opt to pay annually.

- Allows for an unlimited number of repairs, though service call fees and coverage caps on cost will still apply.

- Won’t charge transfer fees if you decide to pass your policy along to the next owner of your home

- The Bronze Care Plan ($58 per month / $630 per year): Covers a total of eight appliances, including cooktops, stove/oven, built-in microwave ovens, refrigerators, dishwashers, garbage disposals, clothes washers, and clothes dryers

- The Gold Care Plan ($57.67 per month / $630 per year): Covers six home systems including, air conditioner, heating systems, plumbing systems, electrical systems, hot water heaters, and ductwork

- The Platinum Care Plan ($62.08 per month / $699.99 per year): Covers all the aforementioned home systems and appliances plus garage door openers, ceiling fans, and plumbing stoppages

- Service Fee: $75 to $125 (varies by state)

- Optional Add-Ons ($39.99- $99.95 per year): Offers bonus coverage for roof leaks, pools/spas, septic systems, lawn sprinkler systems, well/sump pumps, second refrigerators, stand-alone freezers, built-in ice makers, central vacuum, light fixtures, outlets, and switches

Though automatically included in its standard policy terms, Select’s roof leak coverage still has a few limitations. Select Home Warranty will only cover leak repairs for roof damage over occupied living areas of single-family homes (patios excluded). Metal roofing, cracked shingles, tar and gravel, tiles, and several other roofing materials are excluded from coverage. Select also won’t fund repairs requiring partial or complete replacement of the roof. Coverage is capped at $400 per year.

What Is Home Warranty Roof Coverage?

A home warranty is a service contract that covers specific items, mainly home appliances and systems, with the scope of your coverage ultimately depending on the plan level you purchase.

As you examine different policies, you’ll find that roof leak coverage is usually only available at an additional cost outside of most standard home warranty inclusions. Because elective features like roof leak coverage aren’t usually part of a provider’s main policy framework, their coverage can sometimes be relatively narrow and even a bit finicky to qualify for.

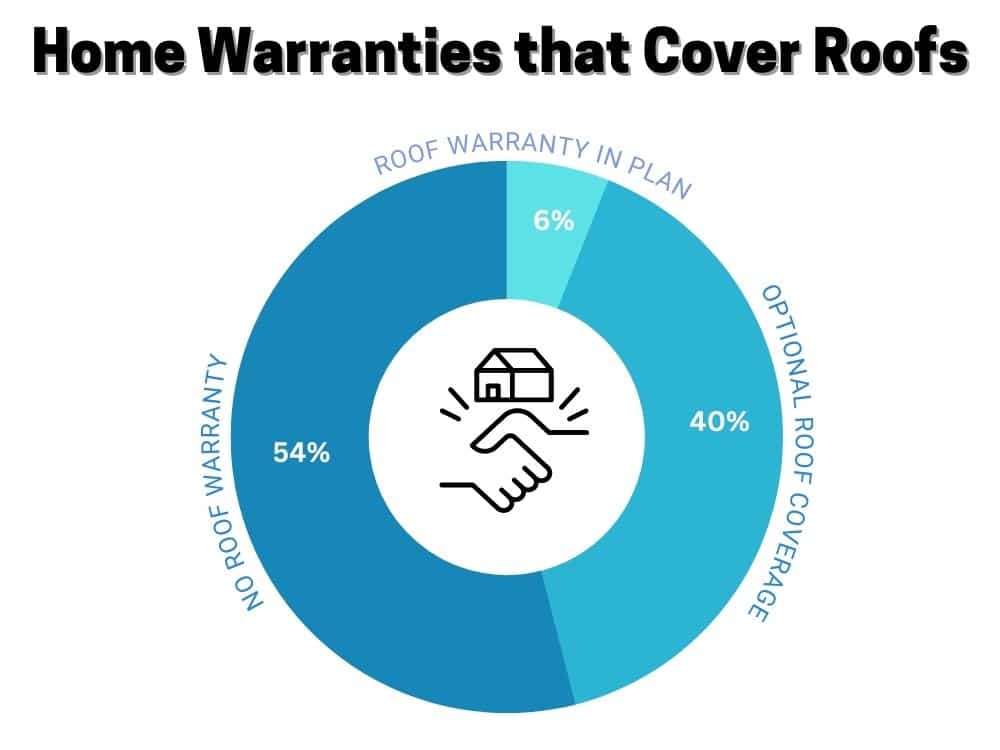

According to our research, only 6% of home warranty companies include roof leak coverage within their policies. However, another 40% of companies offer roof coverage as an optional coverage rider. Some providers, like Select Home Warranty, offer free roof leak coverage with the purchase of a policy.

Nearly 54% of home warranty companies do not offer any sort of roof leak coverage. Home warranty companies such as First American Home Warranty do not offer any sort of roof warranty, whereas some other providers like Liberty Home Guard will only cover roof repairs, not partial or full roof replacements.

Common Roof Coverage Exclusions

Not all roof coverage riders are created equal, and exclusions will vary between companies. Some carriers set annual maximums on how much they’ll pay for repairs, while others may limit repairs to leaks that occur within shared living spaces of the home. Most won’t cover roofs with skylights or roofs made of non-traditional materials like metal, tile, green roofing, etc.

Also, many home warranty providers reserve their roof leak coverage for addressing the source of the leak itself, but not any secondary water damage to your home’s walls, ceilings, insulation, or infrastructure.

Does a Home Warranty Cover Roof Replacement?

Even if your property sustains significant damage due to a roof leak, virtually no home warranty companies will pay for the cost of a complete roof replacement. However, some carriers may estimate how much just fixing the leak would cost and pay you that amount toward the roof replacement.

What Are the Most Common Types of Roofs?

There are six common types of roofing materials: asphalt shingles, slate, metal, wood shakes, clay, and TPO roofing. Each of these types varies in its durability, installation costs, and lifespan. However, no matter what type of roofing material a homeowner chooses to use, there will inevitably be related repair and replacement costs as the roof wears.

Asphalt shingles are the most popular roofing material in the United States. According to the Asphalt Roofing Manufacturers Association (ARMA), over 5 million homes each year (4 out of 5) are roofed with asphalt shingles.

The popularity of shingles is likely due to their affordability, ease of installation, and reasonable lifespan that shingles have. Other leading roofing materials, such as Slate or Clay, are much more durable with lifespans of up to 100 years, but cost significantly more.

All materials and types of roofs are eligible for a home warranty, given that the policyholder adds the roof coverage add-on option to their plan. Our experts recommend Choice Home Warranty, as the company covers the repair of shake, shingle, and composition roof leaks for up to $500 per contract term.

Who Needs a Home Warranty with Roof Coverage?

Your roof is one of the most fundamental parts of your home’s exterior — it provides basic shelter, structural support, and, when well-maintained, can even increase the value of your home if you ever decide to put it up for sale.

We’d recommend that all homeowners add roof coverage to their home warranty unless they’ve recently had a new roof installed on their home during their residence at the property.

The reason is that roofing shingles often come with a limited lifetime manufacturer’s warranty, so long as you were the owner of the home when the roof was installed.

Most manufacturers will still only cover the cost of new shingles, but not labor or replacement costs. Also, any manufacturer’s warranty on roofing materials will only cover factory defects in the product itself and not failures resulting from improper installation. So, after a few years, it’s pretty unlikely that you’ll be able to prove that a roof leak is due to an initial flaw in the material.

Most roofing contractors will guarantee the installation for one or two years, but it can take five or six years for problems to show up, so any workmanship warranty isn’t likely helpful.

Homeowners with a roof over a decade old should consider a home warranty with roof coverage. Homes located in states prone to heavy rainfall — like Mississippi, Florida, and Louisiana — are also better off investing in roof leak coverage ahead of time.

How Much Does a Home Warranty with Roof Coverage Cost?

The cost of home warranty roof coverage is $0 to $125 per year, not including out-of-pocket trade call fees. For some home warranties, like Select Home Warranty, roof coverage is free for the year, whereas for AHS, roof coverage is $79.99.

Ultimately, the amount you’ll pay for a roof leak repair will largely depend on your home warranty provider and whether roof coverage is automatically included or only available as an optional add-on.

Here’s how the five providers featured in this guide compare cost-wise:

| Provider | Cost per year |

| Liberty Home Guard (LHG) | $149.99 (or free when added at sign-up) |

| American Home Shield (AHS) | $39.99 |

| Elite Home Warranty (EHW) | $60+ |

| Choice Home Warranty (CHW) | $70 |

| Select Home Warranty (SHW) | Free |

What Are Roof Replacement and Repair Costs?

Home warranties with roof coverage can save homeowners thousands in repair and replacement costs for their roofs.

New Construction or Replacement Roof Cost

There are many factors that will affect the cost of a new or replacement roof, such as home location, roof material, old roof disposal, and roof square footage. With this in mind, the average new roof in the U.S. costs $8,000, while roofs with more expensive materials can go for upwards of $25,000.

The most affordable roof is 3-tab asphalt shingles(learn more about the cost of asphalt roofing), coming in at $2.38-$3.57 per foot, followed by concrete tiles and wood shingles that average around $4.65-$7 per square foot. Next is a slate roof, which is $7.68-$11.70 per square foot, followed closely by clay tiles, which are $8.55-$12.83 per square foot. On the more expensive side, generic metal roofing costs $17.99-$26.99 and copper roofing costs $15.42 to $23.14. The most expensive roofing is Solar Shingles, coming in at around $33.33-$42.12 per square foot.

Keep in mind that the material cost for roof replacement isn’t the only out-of-pocket cost. Roofing companies also charge up to 60% of the total project cost in labor fees, making roof replacement much more expensive. Also, the total complexity, location, and square footage of the project have a high impact on overall costs.

Roof Repair Cost

Roof repair costs are much more affordable than whole-roof replacements, and will typically be covered by a roof home warranty.

Minor roof repairs will usually cost less than $1,500 per occurrence. Roof leaks are typically the most inexpensive repair, only costing $80-$120, and these are often covered by home warranty policies. If there are a few missing shingles that need repairing, that may only cost $200-$400.

The average cost for shingle repairs is $300-$700, whereas wood shake repairs will land between $400 and $850. More expensive fixes, such as those on metal roofs, will be upwards of $1,000.

DIYing a roof repair can be difficult if you aren’t well-trained in structural roof fixes. A home warranty policy can prevent you from having to climb onto your roof or pay costly fees to a contractor to come to fix it for you. With a home warranty saving you up to $1,000 per year in roof leak coverage, all of your repairs could be completely taken care of.

How Does Roof Home Warranty Coverage Work?

Say you’ve started noticing visible water stains on your interior ceilings. Upon further inspection of your roof, you discovered an area where the shingles have deteriorated with age, allowing rainwater to permeate.

Assuming you have roof leak repair coverage through your home warranty plan, you should call your service provider, who will arrange for a pre-screened technician to come to your home. The technician will determine if the issue is a covered item and if so, they will repair it if possible.

If the roof repair is approved, all you’ll be charged for is the service call, a fee that generally ranges from $75-$125. Pricing is different for each provider, so check your service contract to know your fees and monthly premiums.

Reading through the sample contract of any provider that piques your interest before signing up is the best way to reduce your odds of future claim denials.

Does a Home Warranty Cover Roof Leaks?

Most home warranty policies include a limited roof leak cover within the policy, as an optional add-on, or as a free perk! When signing up for a home warranty policy, if you do not see roof coverage as an option, be sure to contact a sales representative so you don’t miss out on the coverage you need.

So, Is Home Warranty Roof Coverage Worth It?

Home warranties allow you to limit the cost of unexpected repairs because you only have to pay the service fee rather than the entire cost to repair or replace covered appliances or systems.

A typical home warranty with roof coverage covers isolated instances of age-induced deterioration in the roof, plus an array of major systems and appliances that a home buyer may be interested in having covered. Most home roof warranties do not cover roof replacement because of the extensive cost, but roof leaks are covered.

Considering the current national average cost of repairing a minor roof leak is $998 per service appointment, pursuing roof coverage for a yearly payment that rarely exceeds $150 seems like a no-brainer. And, if knowing you’ll only have to pay a small service fee will prevent you from delaying the repair, a home warranty that covers the roof could easily pay for itself.

Today’s Homeowner Home Warranty Ranking Methodology

At Today’s Homeowner, transparency and trust are our most important values for the reader. We’ve done the homework for you and have researched over 50 home warranty companies so you can have the information you need to make the best choice for your home.

Our team spent hours on the phone speaking to representatives from each home warranty company to get information right from the source. We also dug into the fine print on each company’s service agreement to ensure no detail was left out.

To make the most of our research, we developed an objective rating system to score each home warranty company based on the following criteria:

- Plans: Do they provide a variety of plan options? We looked at the number of plans each company offered and the flexibility of adjusting the plan.

- Prices: How reasonable are the monthly and service fees compared to the industry average? We compared the costs of each company to competitors.

- Coverage: How many items are covered in each plan? We looked at the number of items each company covers. We dig into all service contracts available to get all the details.

- Customer service: How is the customer experience when calling the providers? Based on our phone calls, we judged each company’s customer service.

- Trust: What do customers rate the company? We looked into what customers are saying about their experience with the company.

- Nationwide availability: How many states does the company cover? We found the number of states covered by each company.

- Unique perks: Does the company offer discounts or cover special items? We looked for perks offered by each company that set them apart from the competition.